working capital turnover ratio adalah

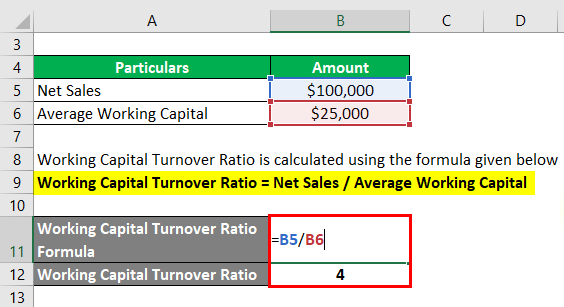

NWC Turnover Ratio Formula. Working Capital Turnover Net Sales Net Working Capital.

Working Capital Turnover Ratio Different Examples With Advantages

600000000 sebuah perusahaan memiliki hutang jangka pendek sebesar Rp.

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

. Working Capital Turnover Ratio is an efficiency ratio that measures the efficiency with which a company is using its working capital in order to support the sales and help in the growth of. Metode lain yang dapat digunakan dalam analisis antara lain adalah receivables ratio inventory-turnover ratio current ratio quick ratio dan days payable. Pengertian Working Capital Turnover Ratio Keuntungan dan Kekurangannya.

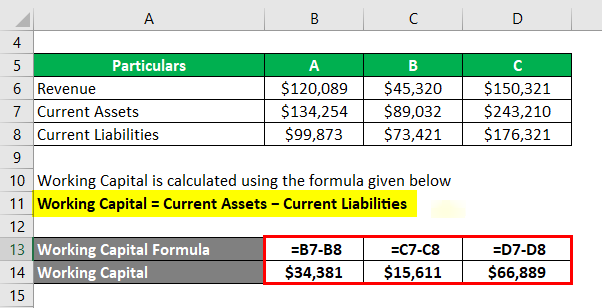

Calculating Working Capital Turnover Ratio provides a clear indication of how hard you are putting your available capital to work in order to help your company succeed. Contoh Kasus Dalam Menghitung Working Capital Turnover Ratio. Berikut ini adalah contoh penghitungan dan interpretasi rasio perputaran modal kerja suatu bisnis.

Rumus-rumus lainnya dalam perhitungan working capital adalah current ratio inventory-turnover ratio receivables ratio quick ratio dan days payable. Nilai rasion Perputaran Modal Kerja dapat ditentukan dengan menggunakan rumus persamaan seperti. Working capital turn over rasio perputaran modal kerja adalah perbandingan antara penjualan dengan modal.

The formula for calculating the NWC turnover is as follows. Working Capital Turnover Formula. Working Capital Turnover WCT Current Ratio CR Debt To Total Assets DTA Return On Investment ROI Abstract Indicator of good working capital management is the.

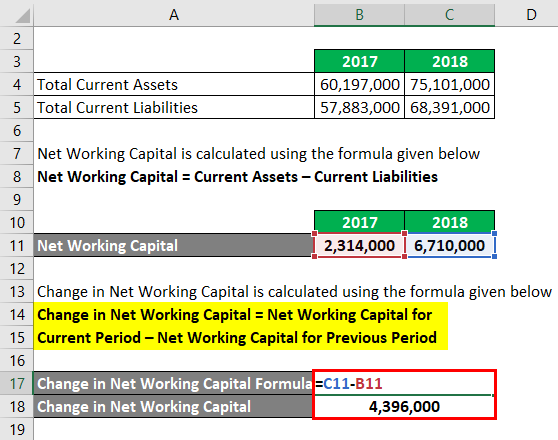

Working Capital Turnover Rp. Working capital ratio current asset. Maka itu net working capital disebut juga dengan istilah modal kerja bersih.

6000000 187 kali Total Assets Turnover. The purpose of this study was to examine and analyze the effect of Working Capital Turnover WCT Current Ratio CR and Total Assets Turnover TATO on Profitability. Contohnya berikut aset sejumlah Rp.

Working Capital Ratio Current Assets Current Reliabilities. Secara sederhana cara menghitung modal kerja bersih atau net working capital adalah. In this formula the working capital is calculated by subtracting a companys current liabilities from its current.

28500000 105 kali Fixed Assets. Dengan data di atas perusahaan kini memiliki aset sebesar Rp500 juta dan utang jangka pendek sebesar Rp50 juta. Obtained by 0429 means that only 429 Profitability Return on Assets ROA is influenced by Working Capital Turnover WCT Current Ratio CR and Total Assets Turnover TATO and the.

Mengitung Rasio Perputaran Modal Kerja Working Capital Turnover WCTO. Working capital turnover Net annual sales Working capital.

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Different Examples With Advantages

Pdf The Effect Of Liquidity And Working Capital Turnover On Profitability At Pt Sumber Cipta Multiniaga South Jakarta

Accounts Payable Turnover Ratio Defined Formula Examples Netsuite

Capital Turnover Definition Formula Calculation

Change In Net Working Capital Formula Calculator Excel Template

Working Capital Turnover Ratio Different Examples With Advantages

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

Working Capital Formula Components And Limitations

Working Capital Policy Relaxed Restricted And Moderate Learn Accounting Accounting And Finance Accounting Books

Analisis Rasio Keuangan Perputaran Modal Kerja Net Working Capital

Pengaruh Inventory Turnover Ratio Account Payable To Cost Of Goods Sold Ratio Net Working Capital To

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Formula Example And Interpretation

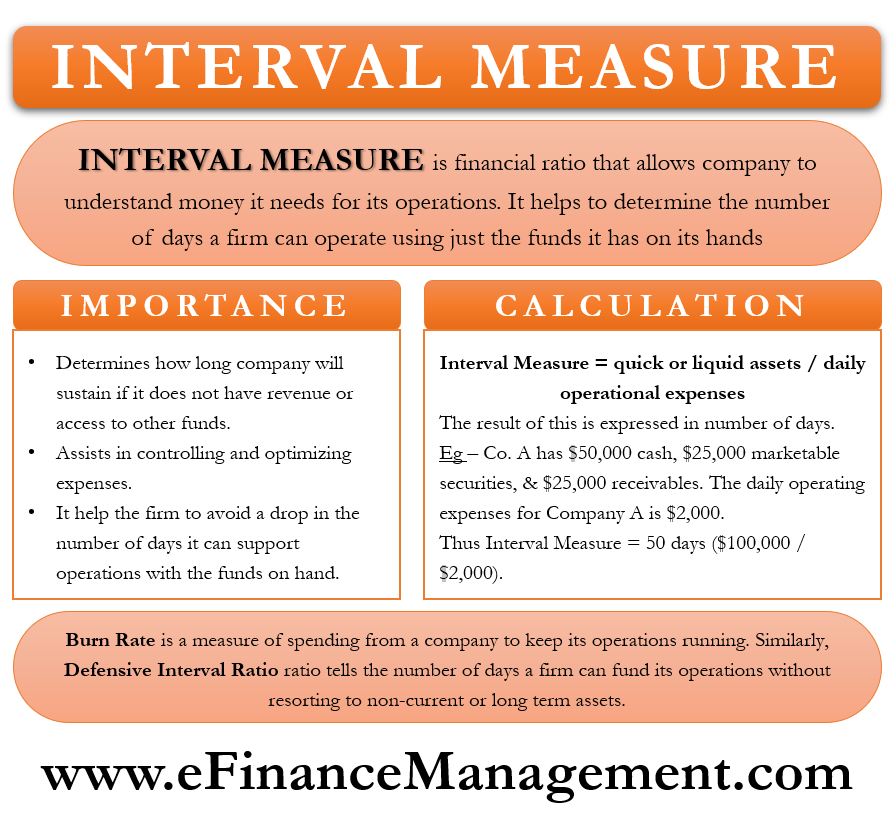

Interval Measure Meaning Importance How To Calculate Burn Rate Efm

Working Capital Analysis Working Capital Is A Powerful Metric By Dobromir Dikov Fcca Magnimetrics Medium

Dupont Analysis Roe Formula And Calculator Step By Step

Working Capital Turnover Ratio Formula Example And Interpretation